2022 tax refund calculator canada

If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. If your taxable income is more than 4528200 enter instead the result of the following calculation.

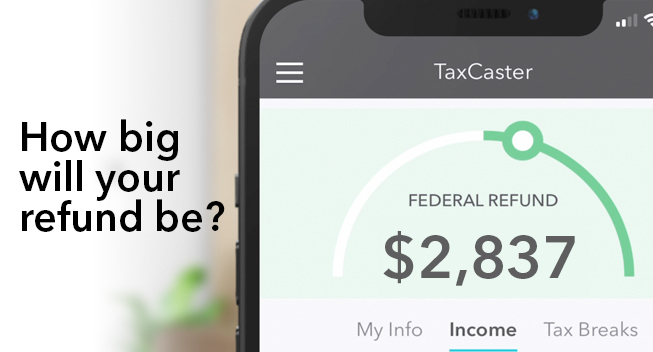

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

We strive for accuracy but cannot guarantee it.

. The Canada Annual Tax Calculator Is Updated For The 202223 Tax Year. Canada Income Tax Calculator for 2021 2022 WOWA Trusted and Transparent Estimate your income taxes by providing a few details about yourself and your income. 2021 free Canada income tax calculator to quickly estimate your provincial taxes.

This calculator is intended to be used for planning purposes. This is an optional tax refund-related loan from MetaBank NA. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

Conquer your income taxes with our free and easy-to-use income tax calculator. It is not your tax refund. 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments.

In 2022 the rrsp dollar limit increased to 29210. We strive for accuracy but cannot guarantee it. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Tax Calculator 2022 Weekly E Jurnal from ejurnalcoid Given that this tool is not unique we wanted to breakdown the logic. If you filed your 2020 return and qualified for interest relief you have until April 30 2022 to pay any outstanding income tax debt for the 2020 tax year to. Or you can choose tax calculator for particular province or territory depending on your residence.

Covid-19 is still a concern several stimulus tax laws are still be challenging for some filers and new tax laws may. Sales Tax Chart For Quebec Canada. The Canada Annual Tax Calculator is updated for the 202223 tax year.

Below there is simple income tax calculator for every Canadian province and territory. The 2022 Tax Year in Ontario runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Calculations are based on rates known as of October 28 2021. Dividends Results Total Income 50000.

This total is then used to determine how much you should get back in your tax refund or how much you owe the irs. Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax. Use this free tax tool to get an understanding of what your 2022 taxes could look like.

2022 indexation brackets rates have not yet been confirmed to CRA data. Tax refund time frames will vary. Tax Refund Calculator 2022 Canada.

The tax documenting cutoff time for most canadians for the 2021 fiscal year is on april 30 2022. All numbers are rounded in the normal fashion. Fastest tax refund with e-file and direct deposit.

This means the dollar limit is the maximum amount you can contribute regardless of your income. Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec. Youll get a rough estimate of how much youll get back or what youll owe.

Select Status Employment Status Self-Employed Tax Year 5. TurboTax Free customers are entitled to a payment of 999. Ad Easily calculate your provincial federal income tax for free with Wealthsimple Tax.

Loans are offered in amounts of 250 500 750 1250 or 3500. Form T2043 Return of Fuel Charge Proceeds to Farmers Tax Credit would need to be completed in order to calculate the amount of the credit. To calculate the sales tax amount for all other values use our sales tax calculator above.

For 2022 The Cra Will Increase The Bpa By 590 To 14398. Below is a table of common values that can be used as a quick lookup tool for a sales tax rate of 14975 in Quebec Canada. Since April 30 2022 falls on a Saturday in both of the above situations your payment will be considered paid on time if we receive it or it is processed at a Canadian financial institution on or before May 2 2022.

Everything you need to know for the 2022 tax-filing season. Average tax rate taxes payable divided by actual not taxable income. The Canada Revenue Agency hosts free tax clinics where a team of.

It includes very few tax credits. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. Amount from line 44 of your Schedule 1 divided by 15.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. Select Province BC AB SK MB ON QC NB NS PE NL 2. 2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors.

Enter the amount of your taxable income from line 260 of your return if it is 4528200 or less. You can also create your new 2022 W-4 at the end of the tool on the tax return result page Start the TAXstimator Then select your IRS Tax Return Filing Status. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022.

For 2021 if youre a farmer in a designated province with eligible farming expenses of 25000 or more you can expect to receive a credit of 147 per 1000 in eligible farming expenses increasing to 173 in 2022. Get your tax refund up to 5 days early. 8 rows If you get a larger refund or smaller tax due from another tax preparation method well.

This deadline is for all personal tax returns that must be filed by this date. British Columbia tax calculator. For instance Emmas 2021 and 2022 taxable income remains.

Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000. The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator. It does not include every available tax credit.

Choose province or territory Choose province or territory Alberta British Columbia Manitoba New Brunswick Newfoundland. In Canada each province and territory has its own provincial income tax rates besides federal tax rates. Annual Tax Calculator 2022.

Use our simple 2021 income tax calculator for an idea of what your return will look like this year. Will the 2022 tax filing season be normal. Get your tax refund up to 5 days early.

This years deadline to file your 2021 tax return. The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. Calculations are based on rates known as of December 21 2021.

Excel Formula Income Tax Bracket Calculation Exceljet

A Perfect Companion For Tax Time The Sharp El738f With A Giveaway Common Cents Mom Financial Calculator Scientific Calculator Calculator

H R Block Tax Calculator Services

How To Calculate Income Tax In Excel

Tax Payment Isometric Legal Service In 2022 Legal Services Tax Payment Online Invoicing

Capital Gains Tax Calculator Real Estate 1031 Exchange Real Estate Investing Rental Property Investment Property Capital Gains Tax

Tax Year 2022 Calculator Refund Estimate E File Returns

Tax Calculator Excel Spreadsheet Youtube

Income Tax Calculator Calculatorscanada Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Simple Tax Calculator For 2021 Cloudtax

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Ontario Income Tax Calculator Calculatorscanada Ca

Ca Income Tax Calculator March 2022 Incomeaftertax Com

How To Calculate Foreigner S Income Tax In China China Admissions

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Income Tax Specialist Certification Course In Kanpur Income Tax Income Project Management Courses