south carolina inheritance tax rate

The top estate tax rate is 16 percent exemption threshold. The average local tax was about 122 percent meaning that the average combined sales tax was about 722 percent.

These Are The 10 Best Places To Live In South Carolina

In 1999 the revenue from the estate tax represented 02 percent of total state revenues.

. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. Still individuals who are gifted more than 15000 in one calendar year are subject to the federal gift tax. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

In the United States the estate tax is a major source of revenue for state and local governments. This chapter may be cited as the South Carolina Estate Tax Act. Any excess over the exemption amount is applied at a rate of 40.

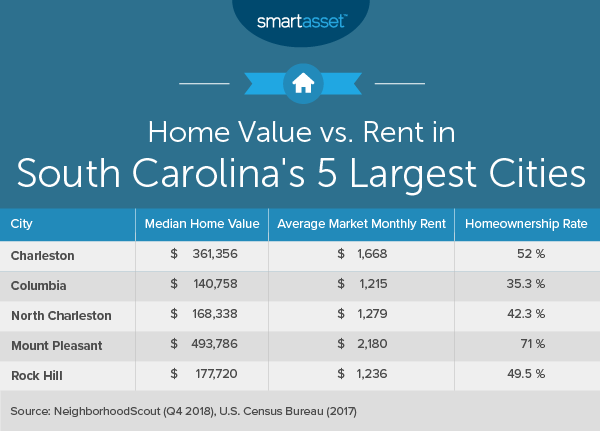

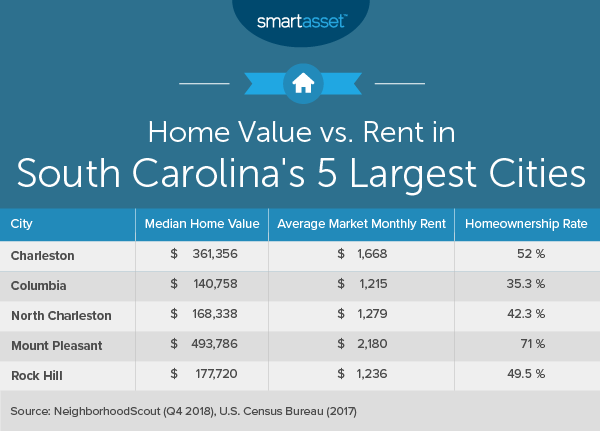

This contributes to the low cost of housing in South Carolina. However that does not mean that there are no taxes or fees that are imposed on an estate in South Carolina. The table below displays the state tax rates average local tax rates and average combined tax rates for South Carolina and its neighboring states.

This chapter may be cited as the South Carolina Estate Tax Act. State Inheritance Taxes. The federal estate tax exemption is 117 million in 2021.

Dying Intestate in South Carolina. South Carolina has no Estate Tax for decedents dying on or after January 1 2005. Federal Estate Tax.

The top estate tax rate is 16 percent exemption threshold. South Carolina inheritance tax and gift tax. This tax is portable for married couples meaning that if the right legal steps are taken a married couples estate of up to 234 million is exempt from the federal estate tax when both spouses.

Not every state imposes the Inheritance Tax and South Carolina is one of many that does not. Ive got more good news for you. But for seniors costs may be even lower.

If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. And in. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax.

The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Inheritance and Estate Tax and.

It is always. However there are 2 important exceptions to this rule. No estate tax or inheritance tax.

It is always. However the rate of these taxes is high and can sometimes reach 40 percent. Tax was permanently repealed in 2014 with repeal of all of SDCL 10-40A effective July 1 2014.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you. South Carolina Estate and Inheritance Taxes. 2 Federal credit means the maximum amount of the credit for state death taxes allowable by Internal Revenue Code Section 2011.

TAX DAY NOW MAY 17th - There are -445 days left until taxes are due. Does South Carolina impose a state death tax on estates of decedents similar to the federal Estate Tax. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. Detailed South Carolina state income tax rates and brackets are available on this page. 1 Decedent means a deceased person.

This means homeowners can expect to pay about 550 for every 100000 in home value. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. No estate tax or inheritance tax.

South Carolinas state sales tax was 600 percent in 2017. Start filing your tax return now. The average effective property tax rate is just 055.

Learn about the state tax rates for income property sales tax and more to estimate your 2021 tax bill. South Carolina income tax rates range from 0 to 7. The top estate tax rate is 16 percent exemption threshold.

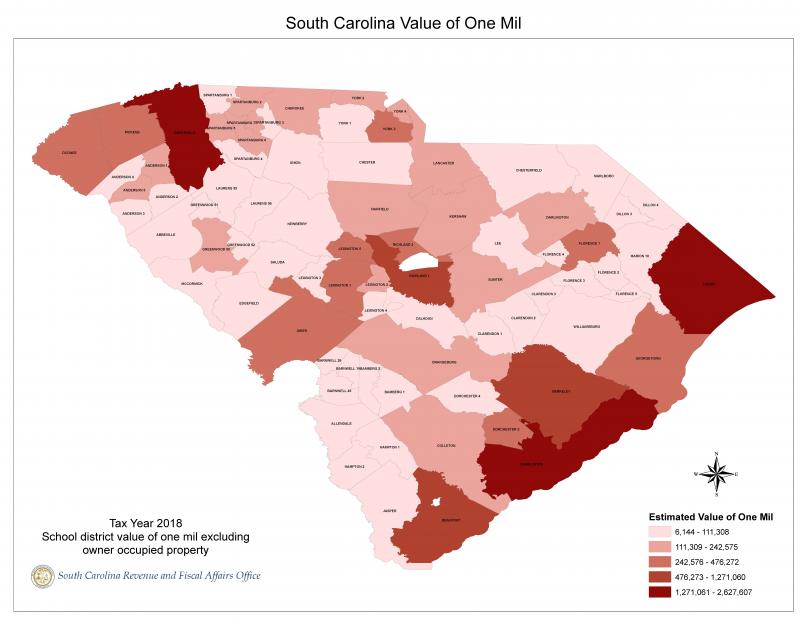

South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds estate soon after the loved one has passed. Indeed most South Carolina homeowners pay less than 1000 annually in property taxes. In South Carolina the median property tax rate is 566 per 100000 of assessed home value.

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Inheritance Laws King Law

South Carolina Sales Tax Small Business Guide Truic

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

The True Cost Of Living In South Carolina

North Carolina Tax Reform North Carolina Tax Competitiveness

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

10 Pros And Cons Of Living In South Carolina Right Now Dividends Diversify

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

A Guide To South Carolina Inheritance Laws

Real Estate Property Tax Data Charleston County Economic Development

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Property Tax Calculator Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

South Carolina Estate Tax Everything You Need To Know Smartasset

Cost Of Living In South Carolina Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Estate Tax Everything You Need To Know Smartasset